Auryn Delivers Positive Preliminary Economic Assessment for HomestakeRidge Gold Deposit

US$108 Million NPV 5% with IRR of 23.6% at US$1,350/oz Gold; US$670/oz gold AISC[1]

US$173 Million NPV 5% with 32% IRR at US$1,620/oz Gold

US$88 Million Pre-Production Capital Expenditures

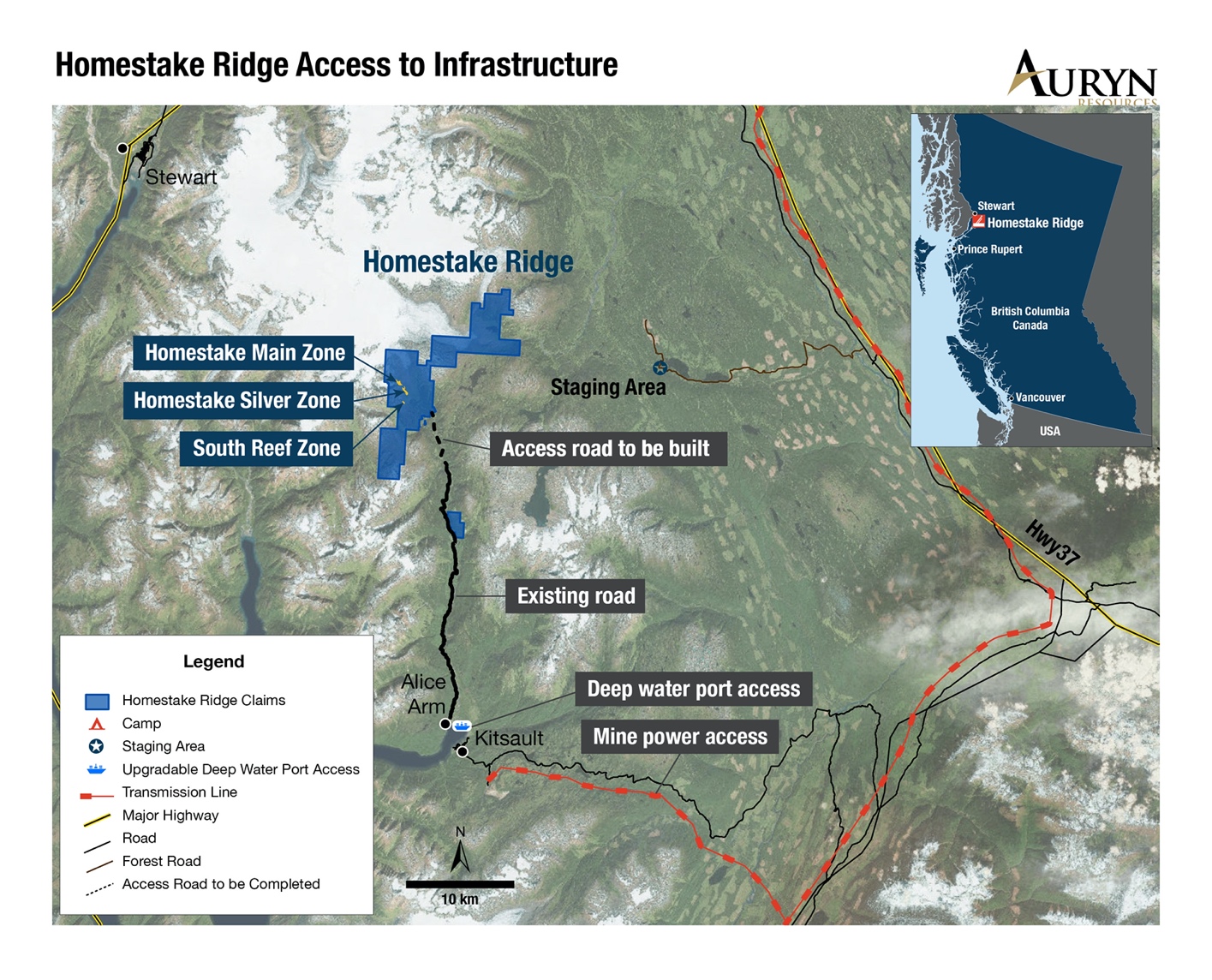

VANCOUVER, BC / ACCESSWIRE / April 15, 2020 / Auryn Resources Inc. (TSX:AUG)(NYSE American:AUG) (“Auryn” or the “Company”) is pleased to announce positive results from an independent preliminary economic assessment (PEA) and an updated resource estimate for its 100% owned 7,500 hectare Homestake Ridge gold project located in the prolific Iskut-Stewart-Kisault gold belt in northwestern British Columbia, Canada (Figure 1). The PEA demonstrates the project’s potential to become a high-grade, small footprint, underground gold mine with positive economics and upside potential from both a rising gold price and prospective expansion. The PEA presentation can be viewed by clicking here, and a visualization of the Life Of Mine (LOM) model can be viewed here.

A Message from Ivan Bebek, Executive Chairman and Director:

“This is an early look into the Homestake Ridge high-grade gold project’s current value, which demonstrates a highly profitable deposit with a low capex in an established mining jurisdiction, and importantly, it is open for considerable expansion.

“We took a conservative approach in our study to see the project’s resilience at $1,350 gold, which generated a 23.6% IRR, however, at $1,620 gold the project generates an IRR of 32% and an NPV of over US$173 million.

“The Homestake Ridge gold project is a valuable part of our portfolio, which also includes multiple tier-one exploration opportunities, such as Sombrero and Curibaya in southern Peru and Committee Bay in northern Canada. We are very much looking forward to advancing our portfolio as we continue to see improving metal prices.”

PEA Summary:

| Base Case: $1,350/oz gold, $12/oz silver, $3.00/pound copper, $1.00/pound lead and an exchange rate of 0.70 (US$/C$) | |

| Net present value (NPV 5%) after tax and mining duties | US$108 million |

| Internal rate of return (IRR) after tax | 23.6% |

| Pre-production capital costs | US$88 million |

| After tax payback period | 36 months |

| All in sustaining costs (AISC) per ounce gold | US$670 |

| PEA life of mine (LOM) | 13 years |

| LOM metal production gold equivalent ounces | 590,040 AuEq ounces |

| LOM average diluted head grade | 6.42g/t AuEq |

| Peak year annual production (year three) | 88,660 AuEq ounces |

| Average LOM payable production | 45,400 AuEq ounces |

| LOM mineralized material mined | 3.4 Million tonnes |

| Mining scenario tonnes per day | 900 tonnes |

The Company cautions that the PEA is preliminary in nature in that it includes Inferred Mineral Resources which are considered too speculative geologically to have the economic considerations applied to them that would enable them to be characterized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The PEA was prepared in accordance with National Instrument 43-101 (“NI 43-101“) by MineFill Services Inc. of Seattle, WA with other contributors including Roscoe Postle Associates Inc. (RPA), now part of SLR Consulting Ltd. (SLR), (QP for updated mineral resource estimate) and One-Eighty Consulting Group (environmental, permitting and social). The Company plans to file the PEA on SEDAR at www.sedar.com within 45 days in accordance with NI 43-101.

Updated Mineral Resource Estimate:

The PEA is based on an updated mineral resource estimate that was prepared in-house by Auryn and audited by RPA using block models constrained to new geological wireframes. Grades for gold, silver, lead, arsenic and antimony were estimated using Inverse Distance (ID3) weighting. Two block models were constructed in Leapfrog Geo Edge software: one for the Homestake Main and Silver deposits and the other for South Reef.

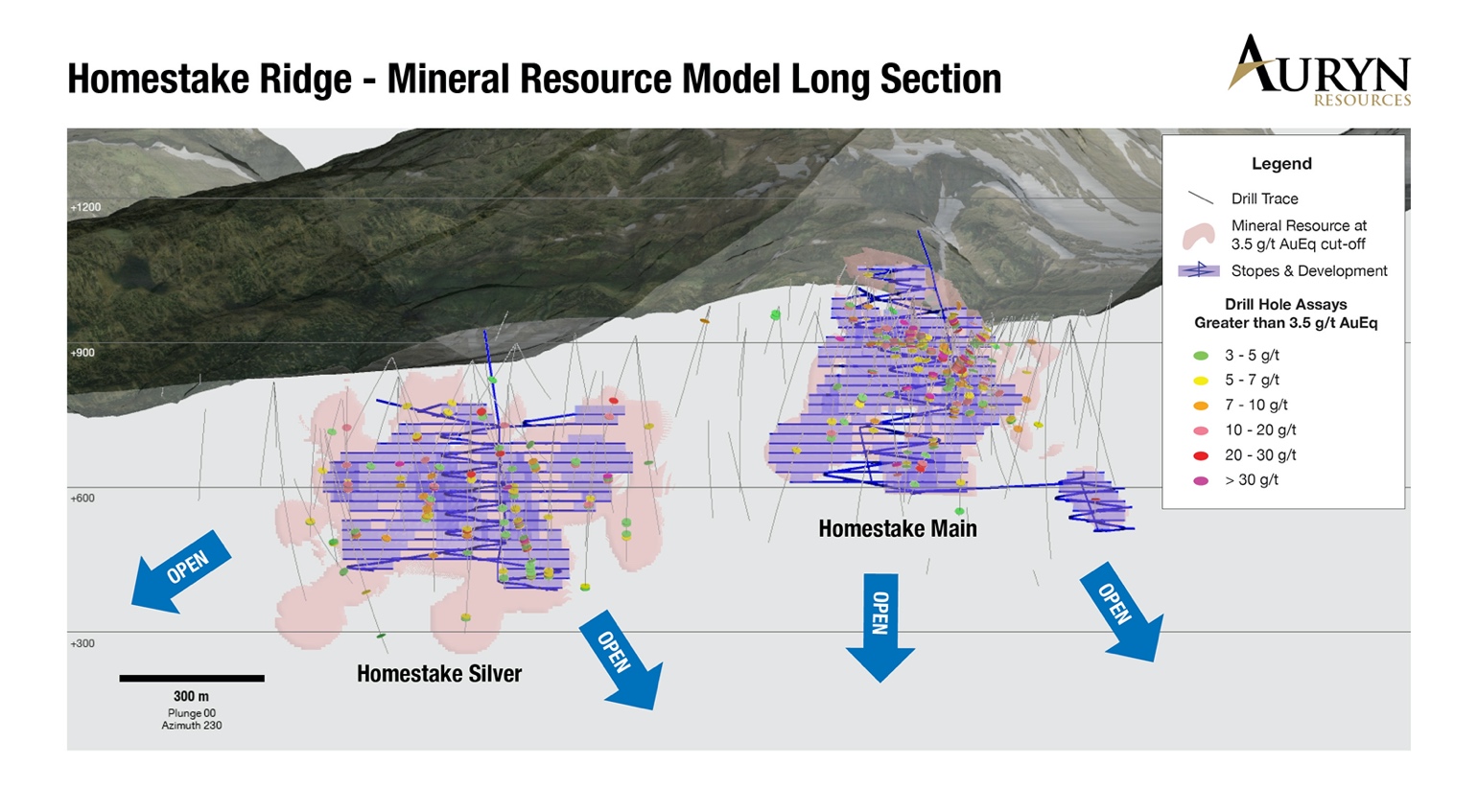

The updated mineral resource estimate was developed using a revised geological model based on a complete re-log of the deposits that defined the geometry of breccia bodies and vein arrays that were successfully traced both laterally and vertically within the deposits. These resulting geometries provided additional confidence in tracing high-grade mineralization within the deposits. The resource remains open for expansion at depth and along strike (Figure 2). The updated mineral resource estimate demonstrates higher grades with a decrease in tonnes as compared to the previous resource estimate dated September 1, 2017 (detailed in a Canadian National Instrument 43-101 Technical Report dated September 29, 2017 as amended October 23, 2017 and filed on SEDAR) with overall metal content largely unchanged. The updated 2019 mineral resource estimate is summarized in Table 1.1 below:

Table 1.1 Mineral Resource by Zone – Effective Date: December 31, 2019

| Average Grade | Metal Content | ||||||||||

| Classification | Zone | Tonnage Mt | Gold g/t | Silver g/t | Copper % | Lead % | Gold oz | Silver Moz | Copper Mlb | Lead Mlb | |

| Indicated | HM | 0.736 | 7.02 | 74.8 | 0.18 | 0.077 | 165,993 | 1.8 | 2.87 | 1.25 | |

| Total Indicated | 0.736 | 7.02 | 74.8 | 0.18 | 0.077 | 165,993 | 1.8 | 2.87 | 1.25 | ||

| Inferred | HM | 1.747 | 6.33 | 35.9 | 0.35 | 0.107 | 355,553 | 2.0 | 13.32 | 4.14 | |

| HS | 3.354 | 3.13 | 146.0 | 0.03 | 0.178 | 337,013 | 15.7 | 2.19 | 13.20 | ||

| SR | 0.445 | 8.68 | 4.9 | 0.04 | 0.001 | 124,153 | 0.1 | 0.36 | 0.00 | ||

| Total Inferred | 5.545 | 4.58 | 100.0 | 0.13 | 0.142 | 816,719 | 17.8 | 15.87 | 17.34 | ||

Notes:

1. Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) definitions), as incorporated by reference in NI 43-101, were followed for Mineral Resource estimation.

2. Mineral Resources are estimated at a cut-off grade of 2.0 g/t AuEq.

3. AuEq values were calculated using a long-term gold price of US$1,300 per ounce, silver price at US$20 per ounce and copper price at US$2.5 per pound and an exchange rate of US$/C$1.20. The AuEq calculation included provisions for metallurgical recoveries, treatment charges, refining costs and transportation.

4. Bulk density ranges from 2.69 t/m3 to 3.03 t/m3, depending on the domain.

5. Differences may occur in totals due to rounding.

6. The Qualified Person responsible for this mineral resource estimate is Philip A. Geusebroek, P. Geo., RPA.

The Mineral Resource sensitivity to cut-off grade is shown on Table 1.2 below.

Table 1.2 Mineral Resource Sensitivity by Cut-Off Grade

| Average Grade | Metal Content | ||||||||

| Cut-off g/t AuEq | Tonnage Mt | Gold g/t | Silver g/t | Copper % | Lead % | Gold oz | Silver Moz | Copper Mlb | Lead Mlb |

| Total Indicated | |||||||||

| 5.0 | 0.372 | 10.99 | 131.3 | 0.20 | 0.120 | 131,463 | 1.6 | 1.7 | 0.99 |

| 4.0 | 0.465 | 9.57 | 111.2 | 0.20 | 0.105 | 142,911 | 1.7 | 2.0 | 1.07 |

| 3.0 | 0.592 | 8.18 | 90.5 | 0.19 | 0.090 | 155,730 | 1.7 | 2.5 | 1.18 |

| 2.0 | 0.736 | 7.02 | 74.8 | 0.18 | 0.077 | 165,993 | 1.8 | 2.9 | 1.25 |

| 1.0 | 0.862 | 6.19 | 65.2 | 0.17 | 0.069 | 171,441 | 1.8 | 3.1 | 1.32 |

| Total Inferred | |||||||||

| 5.0 | 2.158 | 8.25 | 145.7 | 0.21 | 0.216 | 572,444 | 10.1 | 9.8 | 10.26 |

| 4.0 | 2.972 | 6.78 | 133.4 | 0.18 | 0.189 | 648,212 | 12.8 | 11.9 | 12.36 |

| 3.0 | 4.136 | 5.52 | 118.6 | 0.15 | 0.163 | 734,275 | 15.8 | 14.0 | 14.84 |

| 2.0 | 5.545 | 4.58 | 100.0 | 0.13 | 0.142 | 816,719 | 17.8 | 15.9 | 17.34 |

| 1.0 | 6.448 | 4.09 | 90.9 | 0.12 | 0.127 | 847,996 | 18.9 | 17.0 | 18.07 |

PEA Project Overview:

To-date the project has been investigated with more than 275 drill holes, totaling more than 90,000 meters. In addition to the three known zones of mineralization, multiple exploration targets remain to be tested. The PEA envisions a 900 tonne per day underground mining operation spanning a 13-year mine life based on a mine plan using a gold price of US$1,300/oz. Mining would commence in the larger Homestake Main zone first, followed by the Homestake Silver zone around year six and finally the South Reef zone. The material would be treated in a conventional crushing, grinding and flotation plant to produce a copper concentrate, a lead/zinc concentrate and finally Au-Ag dore from cyanide leaching of regrind tailings.

Mining and Processing:

The mine plan and production schedule were developed in Deswik mine stope optimizer software (MSO). The principal mining method in the MSO runs was overhand longhole retreat mining on 20-meter sublevel intervals. The minimum mining width was 2.5 meters and a mining cutoff grade of 3.5 g/t AuEq was used to develop the stope wireframes. An ELOS (equivalent linear overbreak) of 0.25 meters was added at the hanging-wall and footwall to account for dilution.

Processing of the Homestake Ridge mineralization is determined by the difference in metal contents across the three deposits included in the study. Given that 97% of the metal value is gold and silver, the realization of the value of the Homestake Ridge deposits will be dependent on the recovery of precious metals. Based on recent metallurgical test work, the optimal processing stream appears to be campaign processing of each deposit in sequence, rather than blending. The flowsheet thus consists of an initial rougher flotation to produce a base metal concentrate, followed by secondary flotation to produce a pyrite concentrate. The pyrite concentrate is then reground and subjected to cyanide leaching to recover the remaining gold and silver in rougher tailings.

The Homestake Main mineralization would be processed first to produce a copper concentrate rich in gold, then Homestake Silver to produce a lead/zinc concentrate rich in silver and finally South Reef to produce a gold concentrate. The metallurgical recoveries are estimated to be 86% for gold, 74% for silver, 70% for copper and 66% for lead.

Capital and Operating Costs:

The pre-production capital is estimated at US$88 million (CAD$126 million) with US$86 million (CAD$123 million) in sustaining capital, primarily capitalized development underground. The PEA is based on owner-operated equipment and manpower. A contingency of 15% has been applied to all direct costs. Details of the pre-production and sustaining capital are shown on Table 2 below:

Table 2: Capital Cost Summary

| Expenditure | Initial (US$M) | Sustaining (US$M) |

| Mining Equipment | $3.0 | $2.1 |

| Surface mobile equipment | $3.5 | $2.5 |

| Capitalized Underground Development | $66.4 | |

| Tailings | $8.4 | |

| Site Development – Roads, Airport | $6.3 | |

| Camp Facilities | $3.2 | |

| Site Infrastructure | $3.5 | |

| Power Supply | $8.4 | |

| Process Plant | $26.2 | |

| Access Upgrades – barge landing and roads | $2.1 | |

| EPCM costs – 15% of directs | $8.7 | |

| Owner Costs – 10% of directs | $5.8 | |

| Reclamation – tailings | $3.5 | |

| Closure | $3.5 | |

| Water Treatment | $1.4 | |

| Environmental Permits/Baseline Data | $0.6 | |

| End of Life Salvage | ($3.5) |

Operating costs were developed from unit costs for projects of a similar scale in Canada and translated to USD at an exchange rate of 0.70 (US$/C$). A summary of the operating costs is shown in Table 3 below.

Table 3: Operating Cost Summary

| Area | Unit Cost (US$) | Life-of-Mine (US$) |

| Mining ($/t mined) | $63.50 | $182.9 million |

| Processing ($/t milled) | $21.00 | $71.9 million |

| General and Administration ($/t) | $14.00 | $48.0 million |

| Environmental/Water Treatment | $0.82 | $2.8 million |

| Community/Social | $0.17 | $0.6 million |

| Total Operating Costs ($/t milled) | $89.39 | $306.2 million |

Project Economics and Sensitivity Analyses:

The following tables illustrate the PEA project economics and the sensitivity of the project to changes in the base case metal prices, operating costs and capital costs. As is typical with precious metal projects, the project is most sensitive to metal prices, followed by operating costs and initial capital costs.

Table 4: Project Economics at $1,350 Gold

| NPV at 0% (US$M) | NPV at 5% (US$M) | NPV at 7% (US$M) | IRR | Payback (Mo) | |

| Before Tax | $278 | $170 | $140 | 30.1% | 26 |

| After Tax | $184 | $108 | $87 | 23.6% | 36 |

Table 5: Metal Price Sensitivity – After-Tax

| Gold Price (US$/oz) | Silver Price (US$/oz) | NPV at 0% (US$M) | NPV at 5% (US$M) | IRR | Payback (Mo) | |

| 40% | $1,890 | $16.80 | $373 | $239 | 39.4% | 31 |

| 30% | $1,755 | $15.60 | $326 | $206 | 35.8% | 32 |

| 20% | $1,620 | $14.40 | $278 | $173 | 32.0% | 33 |

| 10% | $1,485 | $13.20 | $231 | $141 | 28.0% | 34 |

| Base Case | $1,350 | $12.00 | $184 | $108 | 23.6% | 36 |

| -10% | $1,215 | $10.80 | $137 | $75 | 18.8% | 40 |

| -20% | $1,080 | $9.60 | $90 | $42 | 13.2% | 46 |

| -30% | $945 | $8.40 | $39 | $6 | 6.4% | 75 |

Table 6: Operating Cost Sensitivity – After-Tax

| NPV at 0% (US$M) | NPV at 5% (US$M) | IRR | Payback (Mo) | |

| 20% | $145 | $82 | 20.1% | 39 |

| 10% | $165 | $95 | 21.9% | 38 |

| Base Case | $184 | $108 | 23.6% | 36 |

| -10% | $203 | $121 | 25.3% | 35 |

| -20% | $223 | $134 | 26.9% | 35 |

Table 7: Capital Cost Sensitivity – After-Tax

| NPV at 0% (US$M) | NPV at 5% (US$M) | IRR | Payback (Mo) | |

| 20% | $149 | $79 | 17.1% | 43 |

| 10% | $167 | $93 | 20.1% | 40 |

| Base Case | $184 | $108 | 23.6% | 36 |

| -10% | $201 | $128 | 27.7% | 34 |

| -20% | $219 | $137 | 32.5% | 33 |

Indigenous and Community Relations:

The pursuit of environmentally sound and socially responsible mineral development guides all of Auryn’s activities as the Company understands the broad societal benefits that responsible mining can bring, as well as the risks that must be managed through the implementation of sustainable development practices. Auryn strives to maintain the highest standards of environmental protection and community engagement at all of its projects.

Auryn considers sustainability to include the pursuit of three mutually reinforcing pillars: environmental and cultural heritage protection; social and community development; and, economic growth and opportunity. The Company assesses the environmental, social and financial benefits and risks of all our business decisions and believes this commitment to sustainability generates value and benefits for local communities and shareholders alike.

Auryn places a priority on creating mutually beneficial, long-term partnerships with the communities and countries in which it operates, and with its shareholders, respecting their interests as its own. At the community level, the Company works to establish constructive partnerships to address and contribute to local priorities and interests and ensure that local people benefit both socially and economically from its activities.

Auryn has undertaken early and ongoing engagement with respect to the Homestake Ridge gold project since January 2017. Engagement goals include providing Indigenous groups, residents of nearby communities and other regional interests with corporate and project-related information, details of work programs and other activities being undertaken in the field, project updates and opportunities for feedback and local involvement in the Homestake Ridge project.

Auryn’s approach to Indigenous and stakeholder engagement provides opportunities and benefits through:

- the provision of jobs and training programs

- contracting opportunities

- capacity funding for Indigenous engagement

- sponsorship of community events

Members of local Indigenous groups comprise approximately 40% of Auryn’s Homestake Ridge project team. Two of our primary contractors are local Indigenous-owned companies. Auryn and the Nisga’a Lisims Government entered into a Confidentiality Agreement in January 2020. The parties look forward to a collaborative relationship based on mutual respect and a desire for economic prosperity generated by responsible natural resource development in British Columbia.

Figure 1: Illustrates the general location and access to infrastructure at the Homestake Ridge project.

Figure 2: Illustrates a long section of the Homestake Main and Homestake Silver deposits demonstrating the deposits are open at depth and along strike.

QUALIFIED PERSON:

The foregoing technical information contained in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards for Disclosure for Minerals Projects) and reviewed on behalf of the Company by Dr. David Stone, P.Eng., a Qualified Person.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURYN RESOURCES INC.

Ivan Bebek

Executive Chairman and Director

For further information on Auryn Resources, please contact Natasha Frakes, Manager of Corporate Communications at (778) 729-0600 or [email protected].

About Auryn

Auryn Resources is a technology-driven junior exploration company focused on finding and advancing globally significant precious and base metal deposits. The Company has a portfolio approach to asset acquisition and has six projects, including two flagships: the Committee Bay high-grade gold project in Nunavut and the Sombrero copper-gold project in southern Peru. Auryn’s technical and management teams have an impressive track record of successfully monetizing assets for all stakeholders and local communities in which it operates. Auryn conducts itself to the highest standards of corporate governance and sustainability.

Forward Looking Information and Additional Cautionary Language

Certain information contained in this news release constitutes forward-looking information or forward-looking statements within the meaning of Canadian or U.S. securities laws (“forward-looking statements”). All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that the Company expects to occur are forward-looking statements. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “considers”, “intends”, “targets”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”. More particularly and without restriction, this news release contains forward-looking statements and information about the economic analyses for the Homestake Ridge Gold Project and its potential for development and expansion, the anticipated IRR and NPV for the project, capital and operating costs, processing and recovery estimates and strategies, proposed mining method and development plans, mineral resource estimates and statements as to management’s expectations with respect to, among other things, the matters and activities contemplated in this news release.

Such forward looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The assumptions made by the Company in preparing the forward looking statements contained in this news release, which may prove to be incorrect, include, but are not limited to: the specific assumptions set forth above and in the Technical Report; that the Company is able to develop the property in the manner set out in the Technical Report; that the Company is able to advance the property through to feasibility; that if viable, the Company is able to obtain all necessary permits to develop the mine on the property; that the Company is able to complete the consultation with the Indigenous people in the area of that Homestake Ridge Gold Project; that the exchange rate between the Canadian dollar, and the United States dollar remain consistent with current levels or as set out in this press release; that prices for gold and silver remain consistent with the Company’s expectations; that prices for key mining supplies, including labour costs and consumables, remain consistent with the Company’s current expectations; that Company’s current estimates of mineral resources, mineral grades and mineral recovery are accurate; and that there are no material variations in the current tax and regulatory environment. Many factors, known and unknown, could cause the actual results to be materially different from those expressed or implied.

By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include: availability of financing to fund the Company’s exploration and development activities, the ability of the Company’s exploration program to identify and expand mineral resources, operational risks in exploration and development for gold and silver, the Company’s ability to realize the PEA, delays or changes in plans with respect to exploration or development projects or capital expenditures, uncertainty as to calculation of mineral resources, changes in commodity and power prices, changes in interest and currency exchange rates, the ability to attract and retain qualified personnel, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral resources), changes in development or mining plans due to changes in logistical, technical or other factors, title defects, government approvals and permits, cost escalation, changes in general economic conditions or conditions in the financial markets, environmental regulation, operating hazards and risks, delays, taxation rules, competition, public health crises such as the COVID-19 pandemic and other uninsurable risks, liquidity risk, share price volatility, dilution and future sales of common shares, aboriginal claims and consultation, cybersecurity threats, climate change, delays and other risks described in the Company’s documents filed with Canadian and U.S. securities regulatory authorities. Readers should refer to the risks discussed in the Company’s Annual Information Form and MD&A for the year ended December 31, 2019 and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedar.com and the Company’s registration statement on Form 40-F filed with the United States Securities and Exchange Commission and available at www.sec.gov. Readers should not place undue reliance on forward looking statements.

Cautionary Note to United States Investors

This news release uses the terms “indicated mineral resource” and “inferred mineral resource”, which are Canadian mining terms as defined in and required to be disclosed in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves (“CIM Standards”), adopted by the CIM Council, as amended. However, these terms are not defined terms under Industry Guide 7 (“Industry Guide 7”) under the United States Securities Act of 1933, as amended, and, until recently, have not been permitted to be used in reports and registration statements filed with the U.S. Securities and Exchange Commission (the “SEC”). The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7.

United States investors are cautioned that there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “indicated mineral resources” and “inferred mineral resources” under NI 43- 101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules. United States investors are also cautioned that while the SEC will now recognize “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any “indicated mineral resources” or “inferred mineral resources” that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. In accordance with Canadian securities laws, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101. In addition, United States investors are cautioned that a preliminary economic assessment cannot support an estimate of either “proven mineral reserves” or “probably mineral reserves” and that no feasibility studies have been completed on the Company’s mineral properties.

Accordingly, information contained in this news release describing the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

[1] All-in sustaining cost (“AISC”) is a Non-GAAP measure. The Company has calculated AISC using operating costs (Table 3) as a basis, and then adjusting it in accordance with the World Gold Council guidance.

SOURCE: Auryn Resources Inc.