Fury Outlines 2021 Exploration Program at Homestake GoldSilver Project; 25,000 Metres Focused on Resource Expansion

TORONTO, ON / ACCESSWIRE / February 2, 2021 / Fury Gold Mines Limited (TSX:FURY)(NYSE:FURY) (“Fury” or the “Company”) is pleased to provide an update on exploration plans for the high-grade Homestake Ridge gold-silver project located in the Nisga’a Nation Territory within British Columbia’s Golden Triangle. The Company plans to drill 25,000 metres (m) at the project in the summer of 2021 with the primary goal of expanding the resource and testing high quality gold-silver targets along the deposit trend. In addition, an infill drill program will be conducted with the goal of converting a large portion of the resource at the Homestake Silver deposit from inferred to indicated category.

“The Company has refined the geological model at Homestake Ridge and outlined the largest and most intensive drill campaign at the project to date,” commented Mike Timmins, President and CEO of Fury. “We have identified multiple high priority opportunities to expand the resource and discover additional high-grade gold and silver mineralization at the project. Increasing the ounce profile at Homestake is a key component of our growth strategy and supports the continuous growth we offer to our shareholders.”

Homestake Ridge Deposit Overview

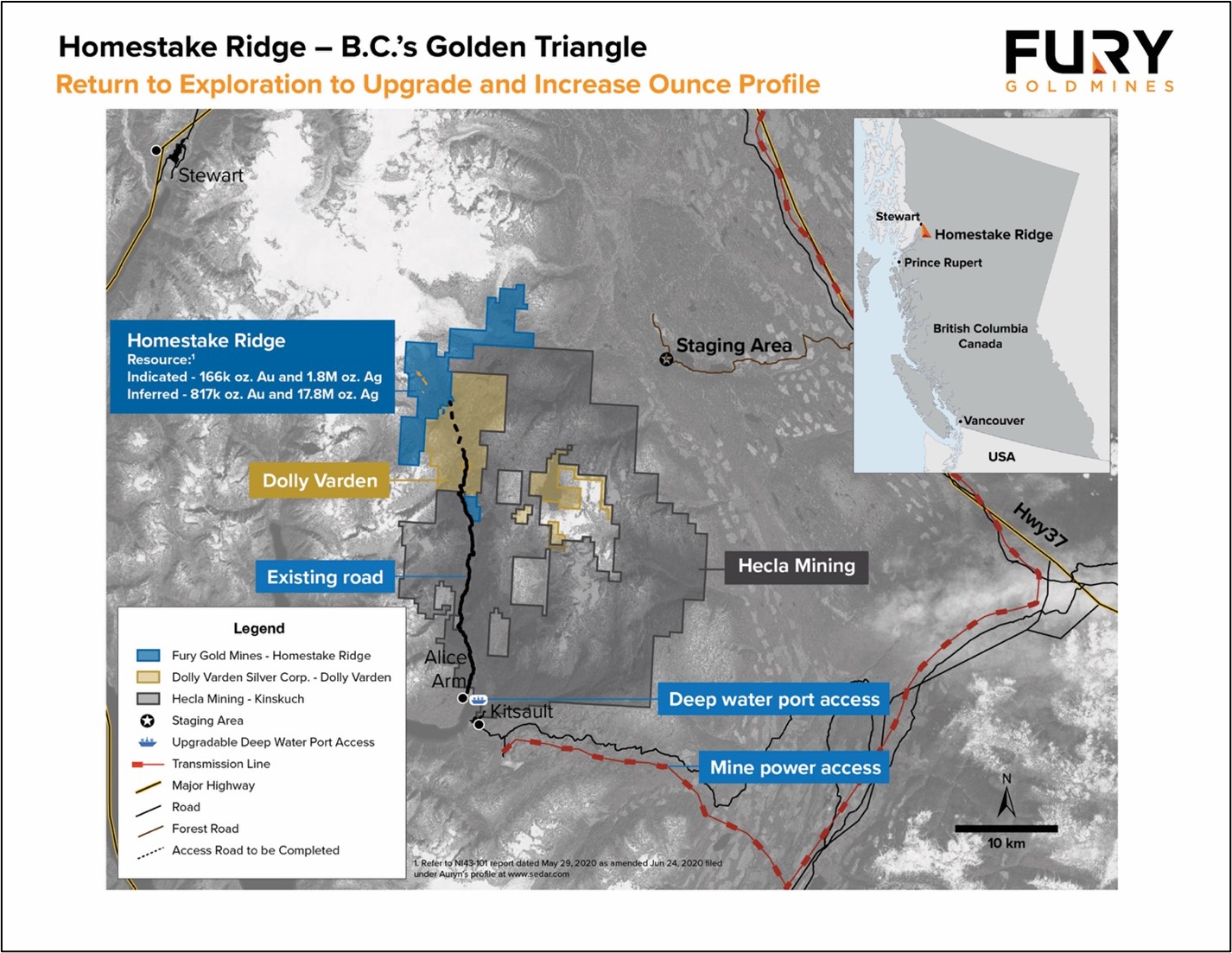

The Homestake Ridge project is comprised of numerous precious metal epithermal occurrences and has a significant resource (Tables 1 and 2). The 7,500-hectare property is located in the Iskut-Stewart-Kitsault belt, approximately 30 kilometres (km) north of the town of Kitsault, with good infrastructure and proximity to high-tension power lines and the deep-water port of Alice Arm (Figure 1). In addition, a serviceable forestry road is located within 6km of the deposit.

Table 1 – Homestake Ridge Deposit Mineral Resource (At a 2.0 g/t Au Eq – cut-off grade)

| Average Grade | Metal Content | ||||||||

| Classification | Tonnage Mt | Gold g/t | Silver g/t | Copper % | Lead % | Gold oz | Silver Moz | Copper Mlb | Lead Mlb |

| Total Indicated | 0.7368 | 7.02 | 74.8 | 0.18 | 0.077 | 165,993 | 1.8 | 2.87 | 1.25 |

| Total Inferred | 5.445 | 4.58 | 100.0 | 0.13 | 0.142 | 816,719 | 17.8 | 15.87 | 17.34 |

Notes:

- Based on the technical report with an effective date of May 29, 2020, as amended and restated June 24, 2020 and titled, “Technical Report, Updated Mineral Resource Estimate and Preliminary Economic Assessment on the Homestake Ridge Gold Project, Skeena Mining Division, British Columbia,” which was filed and is available on the Company’s SEDAR profile at www.sedar.com.

- Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) definitions), as incorporated by reference in NI 43-101, were followed for Mineral Resource estimation.

- AuEq values were calculated using a long-term gold price of US$1,300 per ounce, silver price at US$20 per ounce and copper price at US$2.50 per pound and an exchange rate of US$1.00=C$1.20. The AuEq calculation included provisions for metallurgical recoveries, treatment charges, refining costs and transportation.

- Bulk density ranges from 2.69 t/m3 to 3.03 t/m3, depending on the domain.

Table 2 – Homestake Ridge Deposit Mineral Resource (At a 3.0 g/t Au Eq – cut-off grade)

| Average Grade | Metal Content | ||||||||

| Classification | Tonnage Mt | Gold g/t | Silver g/t | Copper % | Lead % | Gold oz | Silver Moz | Copper Mlb | Lead Mlb |

| Total Indicated | 0.592 | 8.18 | 90.5 | 0.19 | 0.090 | 155,730 | 1.7 | 2.5 | 1.18 |

| Total Inferred | 4.136 | 5.52 | 118.6 | 0.15 | 0.163 | 734,275 | 15.8 | 14.0 | 14.84 |

Notes:

- Based on the technical report with an effective date of May 29, 2020, as amended and restated June 24, 2020 and titled, “Technical Report, Updated Mineral Resource Estimate and Preliminary Economic Assessment on the Homestake Ridge Gold Project, Skeena Mining Division, British Columbia,” which was filed and is available on the Company’s SEDAR profile at www.sedar.com.

- Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) definitions), as incorporated by reference in NI 43-101, were followed for Mineral Resource estimation.

- AuEq values were calculated using a long-term gold price of US$1,300 per ounce, silver price at US$20 per ounce and copper price at US$2.50 per pound and an exchange rate of US$1.00=C$1.20. The AuEq calculation included provisions for metallurgical recoveries, treatment charges, refining costs and transportation.

- Bulk density ranges from 2.69 t/m3 to 3.03 t/m3, depending on the domain.

Figure 1 – Illustrates the location of the Homestake Ridge project within the southern region of British Columbia’s Golden Triangle as well as the infrastructure and project access associated with the deposit.

2021 Drill Program

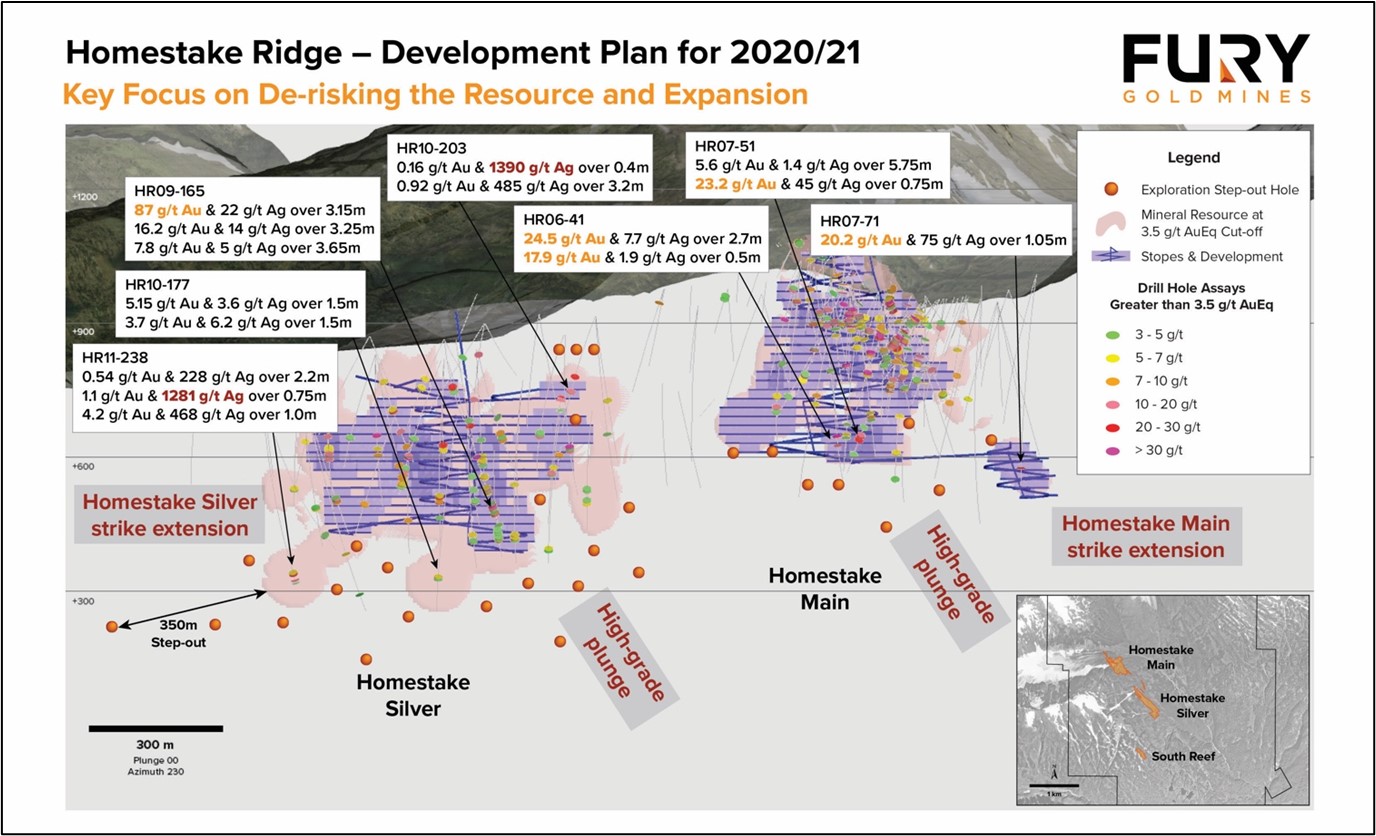

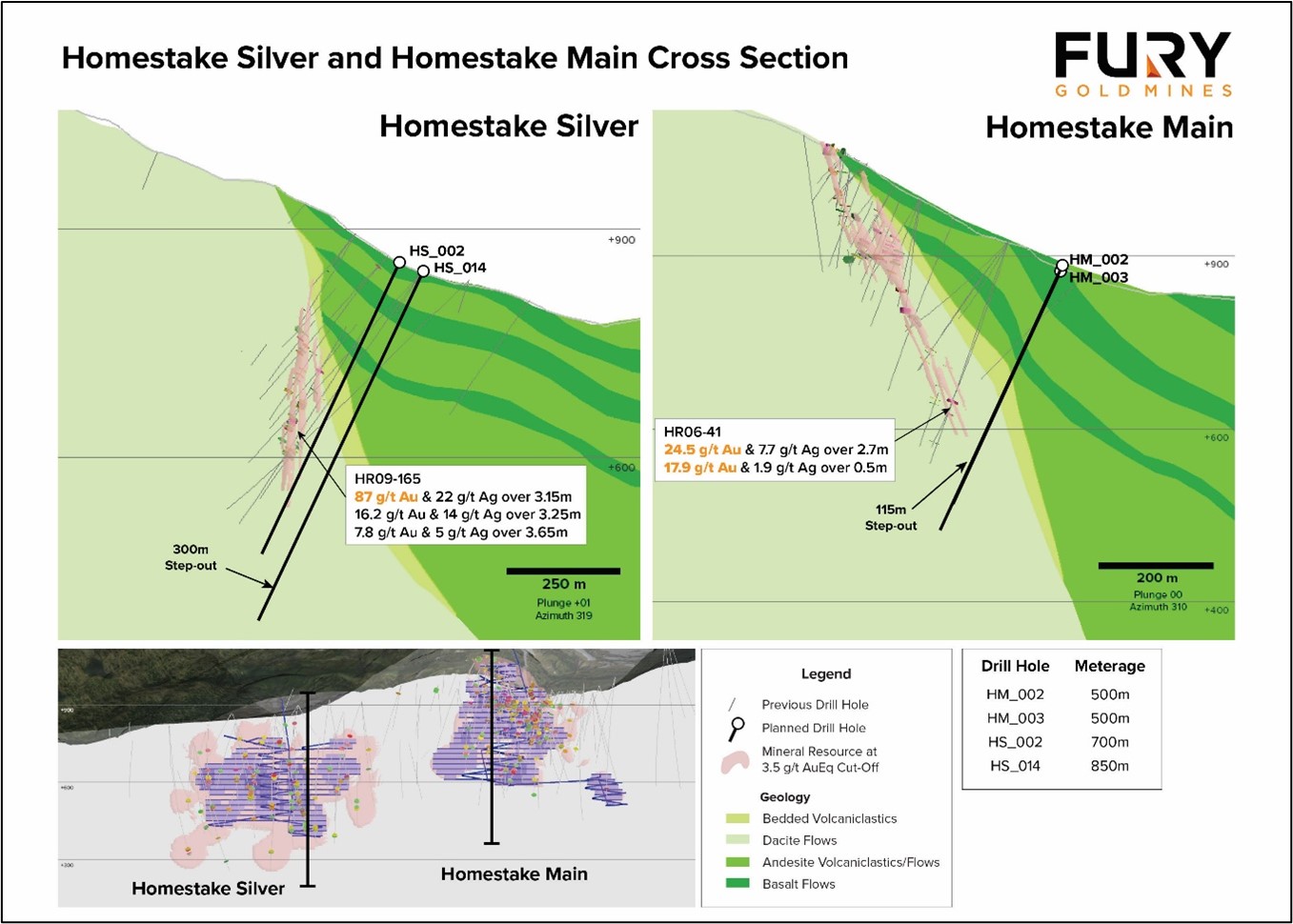

Fury plans to conduct approximately 15,000m of exploration drilling to extend the deposit to depth and along strike. Drilling is expected to begin in the summer of 2021. The deposit extension targets are based upon expanding zones of high-grade mineralization, which are defined by intense silicification, continuous breccia bodies and vein sets that are based on a relog and the recently completed geological model of the deposit (Figure 2). Planned step-outs from these high-grade breccia bodies and vein sets range from 100m to 350m and have the potential to significantly expand the resource (Figures 3 and 4).

“The technical team sees a great deal of potential to expand the resource at Homestake Ridge based on the revised geological model of the deposit,” commented Michael Henrichsen, SVP, Exploration of Fury. “The technical team strongly believes in the discovery potential of new mineralized bodies along the deposit trend, that if successful, could considerably change the size of the project.”

The Company also plans to conduct approximately 10,000m of infill drilling at Homestake Silver. The goal of this program is to upgrade a portion of the resource from inferred to indicated category and to demonstrate the geologic continuity of mineralization based on all recently completed geological data sets and models to-date (Figure 5).

Figure 2 – Breccias and veining of Homestake Main and Homestake Silver deposits.

Figure 3 – Illustrates the resource expansion and exploration drill plan for the Homestake Ridge high-grade gold-silver project. Step-out drill holes are planned to offset the resource between 100m and 350m.

Figure 4 – Illustrates cross sections of the Homestake Silver and Homestake Main deposits and the planned offsets of high-grade mineralization.

Figure 5 – Illustrates the planned infill drill program at Homestake Silver and representative sample of high-grade intercepts within the Homestake Silver deposit.

Michael Henrichsen, P.Geo, SVP of Exploration at Fury, is the Qualified Person who assumes responsibility for the technical disclosures in this press release.

About Fury Gold Mines Limited

Fury Gold Mines Limited is a Canadian-focused exploration and development company positioned in three prolific mining regions across the country. Led by a management team and board of directors with proven success in financing and developing mining assets, Fury will aggressively grow and advance its multi-million-ounce gold platform through project development and potential new discoveries. Fury is committed to upholding the highest industry standards for corporate governance, environmental stewardship, community engagement and sustainable mining. For more information on Fury Gold Mines, visit www.furygoldmines.com.

For further information on Fury Gold Mines Limited, please contact:

Salisha Ilyas, Vice President, Investor Relations

Tel: (778) 729-0600

Email: [email protected]

Website: www.furygoldmines.com

Forward-Looking Information and Additional Cautionary Language

This release includes certain statements that may be deemed contains “forward-looking information” or “forward-looking statements” within the meaning of applicable securities laws and relate to the future operations of the Company and other statements that are not historical facts. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes”, or the negatives and/or variations of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur”, “be achieved” or “has the potential to”. Forward-looking information is information that includes implied future performance and/or forecast information. Forward-looking information and statements in this release reflects management’s current estimates, predictions, expectations or beliefs regarding future events. Specific forward-looking information contained in this release, includes information relating to: Fury’s exploration drill programs at its Homestake Ridge deposit, including with respect to goals thereof and the potential resource upgrades; Fury’s growth plans; and the future growth and development of Fury’s mineral properties.

There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking information reflects the beliefs, opinions and projections on the date such statements are made and are based on a number of assumptions and estimates that, while considered reasonable at the time, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Such assumptions, which may prove to be incorrect, include: general economic and industry growth rates; the Company’s budget, including expected costs and the assumptions regarding market conditions; the Company’s ability to raise additional capital to proceed with its exploration, development and operations plans; the Company’s ability to obtain or renew the licenses and permits necessary for its current and future operations; and the Company’s assumptions around the impact of the COVID-19 pandemic. Although the Company believes that the assumptions and expectations reflected in those forward-looking statements were reasonable at the time such statements were made, there can be no assurance that such assumptions and expectations will prove to be correct.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different (either positively or negatively) from any future results, performance or achievements expressed or implied by such forward-looking statements, including risks relating, but not limited, to: the COVID-19 pandemic; the future price of minerals, including gold and other metals; and the success of the Company’s exploration and development activities. Readers should refer to the risks discussed in the Company’s Annual Information Form and MD&A for the year ended December 31, 2019 and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedar.com and the Company’s Annual Report on Form 40-F for the year ended December 31, 2019 filed with the United States Securities and Exchange Commission and available at www.sec.gov. Readers should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this news release is expressly qualified by this cautionary statement. The forward-looking information and statements contained in this press release represent the Company’s expectations as of the date of this press release or the date indicated. The Company disclaims any intention or obligation or undertaking to update or revise any forward-looking information or statements whether as a result of new information, future events or otherwise, except as required under applicable securities law.

Cautionary Note to United States Investors Concerning Estimates of Mineral Resources

This release uses the term “mineral resources”, which is defined with reference to the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) CIM Definition Standards on Mineral Resources and Mineral Reserves (“CIM Standards”). The Company’s descriptions of its projects using CIM Standards may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.